Condo Insurance in and around Baltimore

Looking for great condo unitowners insurance in Baltimore?

Insure your condo with State Farm today

Welcome Home, Condo Owners

Because your home is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to vandalism or weight of ice. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Looking for great condo unitowners insurance in Baltimore?

Insure your condo with State Farm today

Protect Your Condo With Insurance From State Farm

Despite the possibility of the unpredictable, the future looks bright when you have the dependable coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your unit and personal property inside, you'll also want to check out options for replacement costs bundling, and more! Agent Scott Garvey can help you develop a policy based on your needs.

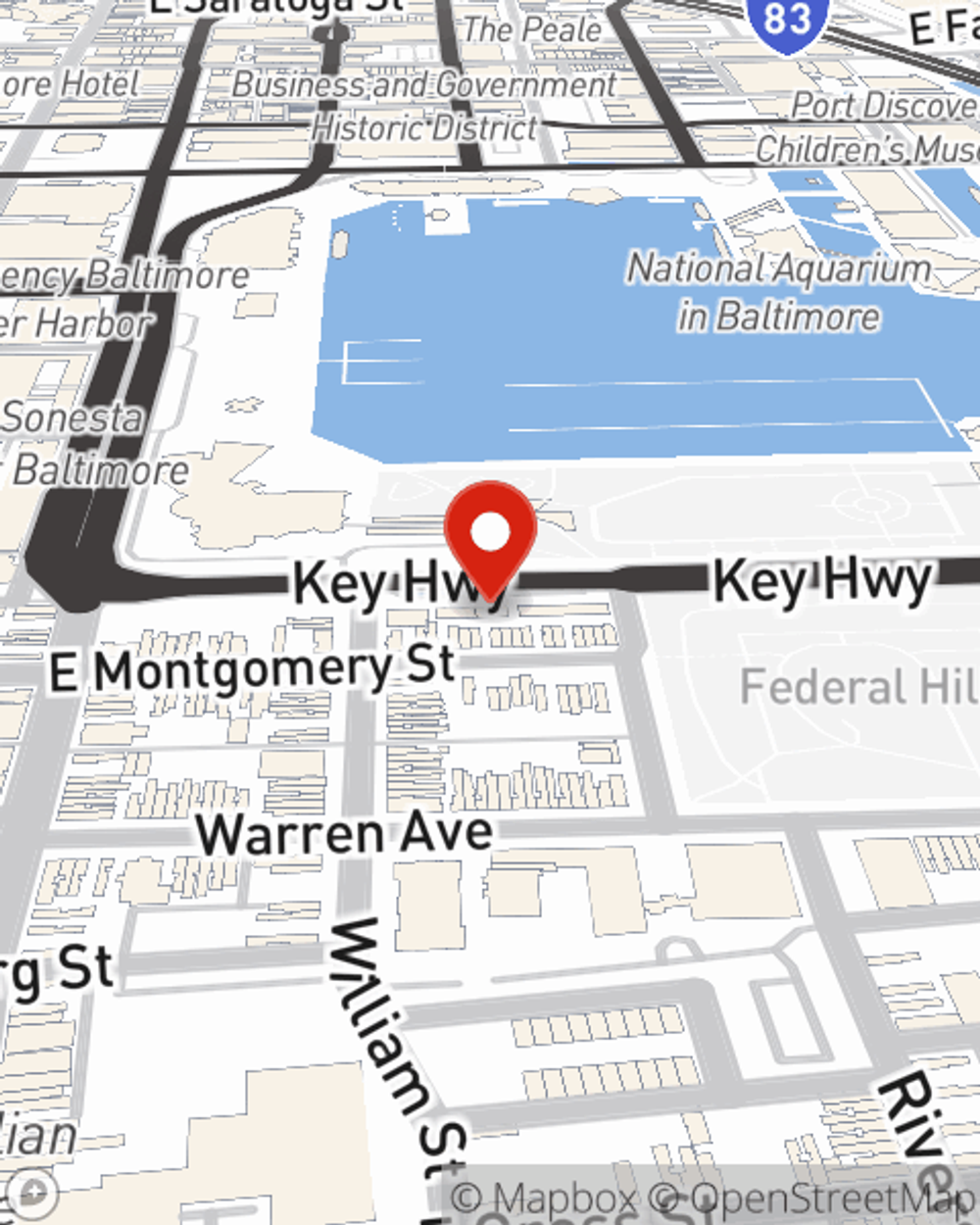

Contact State Farm Agent Scott Garvey today to find out how one of the leading providers of condominium unitowners insurance can help protect your condominium here in Baltimore, MD.

Have More Questions About Condo Unitowners Insurance?

Call Scott at (443) 759-4441 or visit our FAQ page.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Scott Garvey

State Farm® Insurance AgentSimple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.